A Health Savings Account (HSA) can be a smart way to pay for medical expenses without paying taxes on them. And there are other benefits as well. For example, you can:

- Claim a deduction for HSA contributions you make even if you don’t normally itemize your deductions when you do your taxes.

- Benefit from contributions that your employer makes to your HSA as they may not be included in your gross income.

- Enjoy tax-free interest and tax-deferred earnings on assets in your HSA.

- Receive a distribution tax-free if you pay for qualified medical expenses.

- Take your HSA with you if you change employers or leave the workforce.

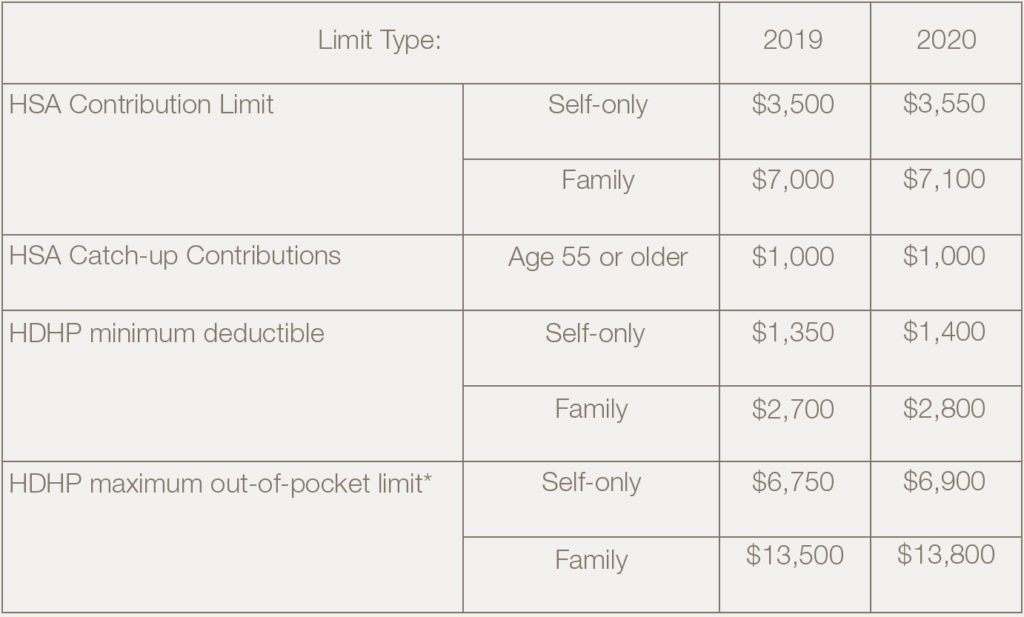

As you review your health coverage for 2020, you may be thinking about your Health Savings Account (HSA) and determining the amount you’ll want to contribute. While it’s important to consult your tax adviser on what is best for you before making any decisions, it’s critical to understand the basics of what’s changed for 2020—for HSAs as well as high-deductible health plans (HDHPs).

Here are the highlights:

*Included: items like deductibles, copayments, and coinsurance. Not included: premiums.

To dive deeper into the details, consult your tax adviser, visit the IRS website or go to Dundee Bank’s Health Savings Account page. Our HSAs have a $0 minimum balance, no set up fees, no monthly minimum balance requirements and a free debit card.